Nvidia, the leading graphics chip maker, has reported a staggering 122% year-over-year revenue increase for the second quarter of fiscal 2025, driven largely by surging demand for its data center chips used in artificial intelligence applications. The company's financial results, reported by WebProNews, highlight Nvidia's dominant position in the AI hardware market and its successful pivot from gaming to AI infrastructure.

Nvidia posted a record revenue of $30 billion for Q2 FY25, up 15% from the previous quarter and more than doubling its revenue from the same period last year. Net income also saw an impressive rise, more than doubling to $16.6 billion, or $0.67 per share, compared to $6.18 billion, or $0.25 per share, a year ago.

The data center segment was the driving force behind this growth, with revenue climbing 154% year-over-year to $26.3 billion, accounting for 88% of Nvidia's total sales. This performance reflects the company's successful transition from its roots in gaming to becoming a leader in AI infrastructure.

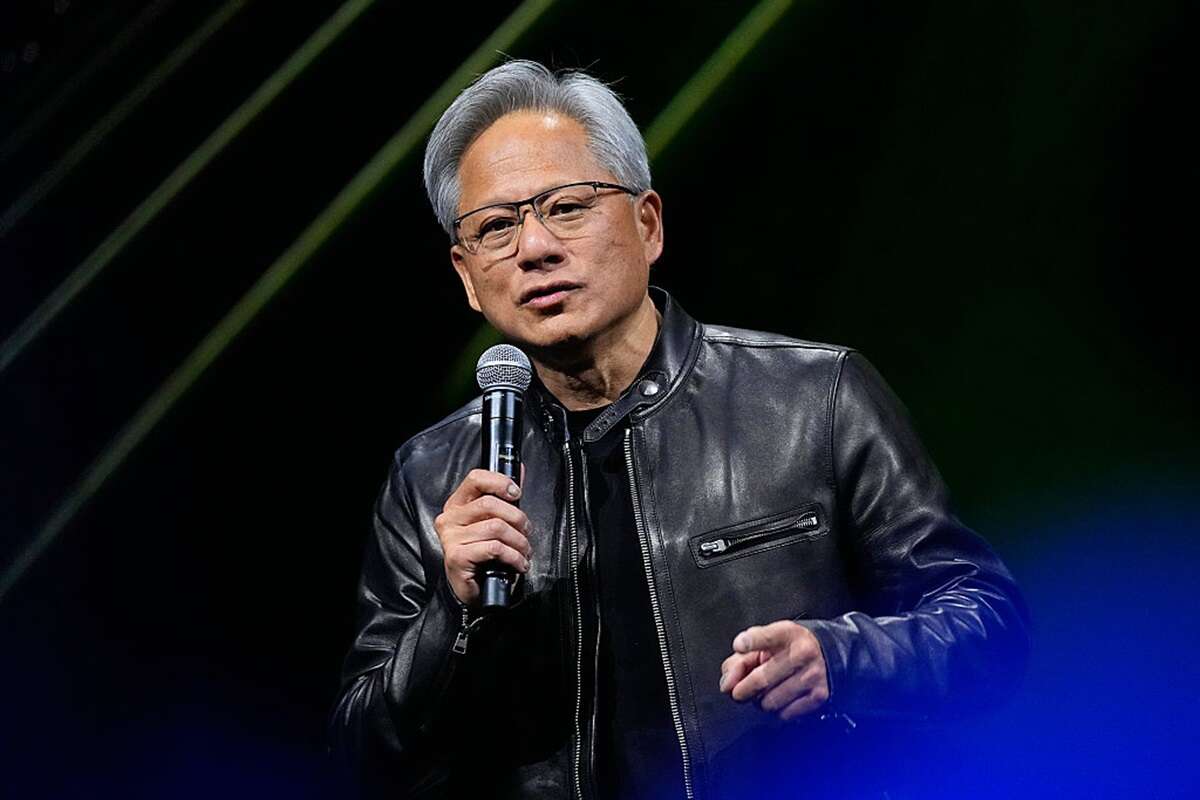

"This quarter's results are a reflection of the massive global effort to modernize the entire computing stack with accelerated computing and generative AI," said Jensen Huang, Nvidia's CEO. "Hopper demand remains strong, and the anticipation for Blackwell is incredible. We are helping frontier model makers, consumer internet services, and now enterprises to revolutionize every industry with generative AI."

Nvidia's GPUs, particularly the H100 and H200, have become essential for training large language models and performing complex AI computations. This has driven unprecedented demand for Nvidia's products, with major tech companies like Google, Amazon, Microsoft, and Meta heavily investing in AI-focused data centers that rely on Nvidia's chips.

Despite the record-breaking performance, Nvidia faced some challenges. The company's gross margin slipped slightly in the quarter to 75.1%, down from 78.4% in the previous quarter, though it remains up from 70.1% a year ago. This dip in margin is largely attributed to production issues with the Blackwell chips, which required a design tweak to improve manufacturing efficiency.

Huang addressed these challenges during the earnings call, stating, "We have faced some production challenges with Blackwell, but I want to assure everyone that these issues have been resolved. We are ramping up production, and we expect supply to meet the extraordinary demand we are seeing."

The company is also expanding beyond AI, with growth reported in its gaming, professional visualization, automotive, and robotics segments. The gaming segment saw a 16% revenue increase to $2.9 billion in Q2 FY25, driven by increased shipments of PC gaming cards and higher demand for game console chips. "We are in the early stages of a technological revolution that will reshape every industry," Huang said. "Nvidia is leading this revolution, and we are confident in our ability to deliver value to our shareholders and customers over the long term."

A fascinating comparison of the recent valuations of three very different types of investments:

Two are #tech-era instruments. One is very traditional + has a very different growth curve and hence purpose. Another is a key part of the #FutureOfMoney. https://t.co/PwXqUim8Ol pic.twitter.com/uTTaOIWLoU

— Dm@x (@seautocure) August 28, 2024

Looking ahead, Nvidia's outlook for the third quarter of fiscal 2025 remains optimistic. The company expects revenue to reach approximately $32.5 billion, representing an 80% year-over-year increase. This guidance reflects continued strong demand for Nvidia's AI chips, particularly from major cloud service providers and tech giants. "Our strategy is to continue pushing the boundaries of what's possible with AI and accelerated computing," Huang said. "We are committed to driving innovation across our entire product portfolio, from AI chips to cloud services, to help our customers succeed in this rapidly evolving landscape."

Despite the positive financial results, Nvidia's stock experienced a significant dip of over 6% in after-hours trading following the earnings announcement. This decline was largely driven by concerns over the company's gross margin and the potential impact of production issues on future revenue.

However, many investors remain bullish on Nvidia's long-term prospects. The company's stock is up more than 150% year-to-date, following a nearly 240% increase in 2023. Nvidia's market cap recently surpassed $3 trillion, briefly making it the most valuable public company globally, second only to Apple.